Money is the tool of men who have reached a high level of productivity and a long-range control over their lives. Money is not merely a tool of exchange: much more importantly, it is a tool of saving, which permits delayed consumption and buys time for future production. To fulfill this requirement, money has to be some material commodity which is imperishable, rare, homogeneous, easily stored, not subject to wide fluctuations of value, and always in demand among those you trade with.The Lexicon adds:

This leads you to the decision to use gold as money. Gold money is a tangible value in itself and a token of wealth actually produced. When you accept a gold coin in payment for your goods, you actually deliver the goods to the buyer; the transaction is as safe as simple barter. When you store your savings in the form of gold coins, they represent the goods which you have actually produced and which have gone to buy time for other producers, who will keep the productive process going, so that you’ll be able to trade your coins for goods any time you wish.The Money is Debt video does not propose a specific money system that is NOT debt based but does suggest various intriguing alternatives. Honest Money by Gary North lays out the requirements for honest money, which clearly show how corrupt central banks fiat/fractional reserve currency is and overlaps with the Objectivism Lexicon in principle:

1. We shouldn’t expect something for nothing, such as the depositor’s withdrawal on demand of loaned-out funds, or counterfeit money making everyone richer.A couple of other considerations include Fractional reserve Deposit Multiplier via Investopedia: "reserve" is in denominator. This means a "10%" reserve allows banks to lend out x/.1 = 10x

2. The State shouldn’t interfere with private non- coercive decisions (contracts).

3. It is cheaper to print paper money than it is to mine metals.

4. Money isn’t money unless people expect other people to accept it in trade later on, meaning:

5. Money requires continuity of acceptance over time.

6. Debasing money is a form of tampering with weights and measures.

7. Debasing money reduces its value in trade.

8. Debasing money therefore reduces the wealth of people who hold money.

9. Warehouse receipts should be backed 100 percent at all times by whatever is promised by the receipt.

A 5% reserve allows banks to lend out x/.05 =20x

2% reserve = x/.02 = 50x

1% reserve = x/.01 = 100x. Selling what you do not own is fraud. Just because it is money and not cars does not make it not fraud.

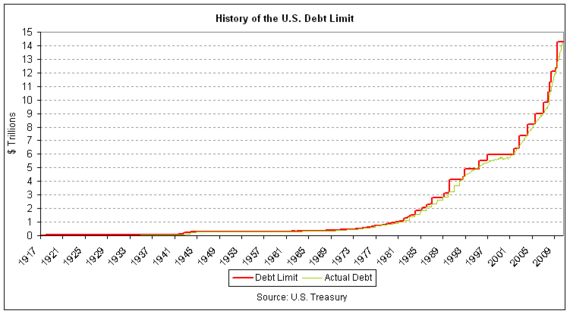

With debt as money. The money supply increases upon each loan taken out, i.e., Principle (P). Where does the money from from to pay the interest on the loan, i.e., P+I? Perpetual growth, perpetual loans, perpetual diluting of the money supply. Does anyone think this is sustainable?

And the inverse relationship between debt and the value of the dollar is unmistakable - exponential.

For more info read End the Fed by Ron Paul. And consider A zero-growth economy is incompatible with a fractional reserve banking system.

Sustainable, Honest Money v Central Banks, Debt As Money

Aucun commentaire:

Enregistrer un commentaire